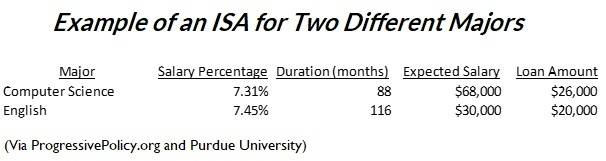

An Income Sharing Agreement is a financial agreement between a lender and a perspective student where a loan is made in exchange for a percentage of income (after graduation.) The loan amount and repayment length are based on the school tuition, as well as “risk factors” like potential earnings based on choice of program or major.

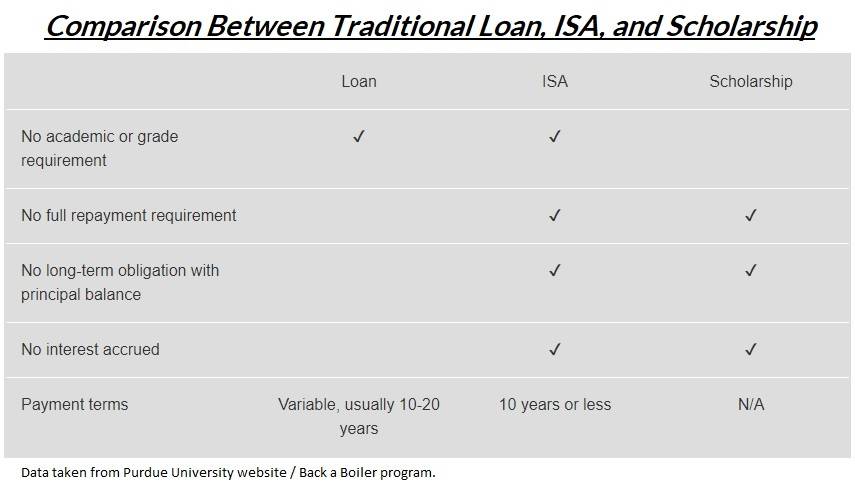

Unlike a traditional loan: the repayment terms are based on the salary earnings of the borrower, rather than credit score or other factors. This means that a working graduate will pay a small percentage of their salary, instead of a fixed payment, until either the loan is repaid, or the time limit expires. Another important factor is that most ISA’s will cap out at a certain amount. For example: if the student gets a high-paying job – s/he will finish the loan early via her higher salary. This protects the student from overpayment. Another benefit is that there is always a minimum earnings threshold that the borrower must meet before payments are made. This protects borrowers who lose their jobs or fail to secure a certain level of gainful employment (unlike traditional loans, where you must pay regardless – or risk damaged credit score, debt, or default.)

Unlike a traditional loan: the repayment terms are based on the salary earnings of the borrower, rather than credit score or other factors. This means that a working graduate will pay a small percentage of their salary, instead of a fixed payment, until either the loan is repaid, or the time limit expires. Another important factor is that most ISA’s will cap out at a certain amount. For example: if the student gets a high-paying job – s/he will finish the loan early via her higher salary. This protects the student from overpayment. Another benefit is that there is always a minimum earnings threshold that the borrower must meet before payments are made. This protects borrowers who lose their jobs or fail to secure a certain level of gainful employment (unlike traditional loans, where you must pay regardless – or risk damaged credit score, debt, or default.)

How can Income Sharing Agreements Help?

How can Income Sharing Agreements Help?

Firstly, and most importantly, an ISA leaves the borrower (or their parents!) with no unsustainable debt. The loan is repaid only when the borrower is earning real income, above a certain minimum, and will not affect the credit or livelihood of a borrower who has fallen on hard times.

Secondly, it allows schools and funding organizations to prioritize funding based on real market job needs and salary projections. This might even help students reconsider their studies, and plan for their futures better.

Thirdly, it encourages meritocracy. Unlike traditional loans and many federal aid programs: an ISA does not use credit scores. This allows schools to onboard the most promising students from across all backgrounds, ethnicities, other demographics, and income levels. According to the National Center for Education Statistics, only 14% of students in the bottom quartile of income who start an Associate degree program will go on to finish their Bachelor’s degree. This is compared to over 60% of students from the top quartile of income. An ISA can do away with all of this systemic bias.

Finally, at the end of the day: an ISA forces schools to become invested and take an active role in student success! Many students complain that their school’s interest in them only lasts until commencement. The ISA offers colleges and universities a chance to prove that they understand the employment goals of students, and that they’re prepared to stand by their alumni.

Interested to learn more? Check out our degree programs or contact us at (848) 299-5900.